Potential Approaching Storm in Commercial Real Estate: Recent Updating of Great Recession Guidance

Nearly 14 years ago, guidance was provided by federal regulators to facilitate commercial real estate loan work-outs.

Rather than ‘extend & pretend,’ regulators had encouraged, and are encouraging, banks to work with creditworthy borrowers to provide relief on commercial real estate loans.

Current Challenging Environment

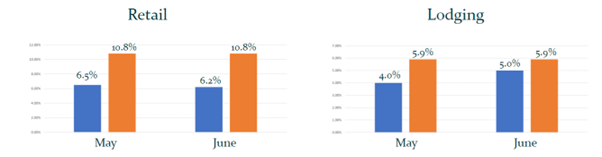

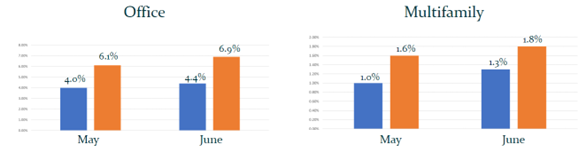

US CMBS – S&P Global Ratings

(May-June 2023)

![]()

Highest Metro Vacancy Rates

(May 2023)

|

Metro Area |

total vacancy |

12-month change |

|---|---|---|

|

1. Houston |

23.2% |

-1.5% |

|

2. Austin |

20.7% |

4.4% |

|

3. Denver |

20.2% |

3.0% |

|

4. San Francisco |

20.0% |

2.8% |

|

5. Seattle |

19.5% |

3.8% |

|

6. Atlanta |

19.4% |

-0.5% |

|

7. Chicago |

18.8% |

-0.9% |

|

8. Nashville |

18.5% |

1.0% |

|

9. Phoenix |

18.5% |

4.4% |

|

10. Bay Area |

17.7% |

2.3% |

Source: CommercialEdge National Office Report, June 2023

In addition, CommercialEdge reports that the Austin, Nashville, San Francisco and Seattle metro areas have new construction in the pipeline comprising at least 5% of its existing office space, thus exacerbating the weak office vacancy situations in these markets.

Updated Guidance

General

The basis of this alert is the updated guidance issued by the Federal Reserve, the Federal Deposit Insurance Corporation (FDIC), the Office of the Comptroller of the Currency (OCC), and the National Credit Union Administration (NCUA). The guidance addresses real estate with diminished operating cash flows, depreciated collateral values, and prolonged sales and rental absorption periods in today’s challenging real estate environment.

In the future, regulators may consider separate bank guidance to address accommodations and workouts outside of the real estate area.

Key Principals

This guidance reaffirms two key principals from 2009:

- Prudent accommodations and workouts will not be subject to criticism from regulators

- Modified loans will not be subject to adverse classification solely because of ‘underwater’ collateral

Borrower Engagement

Regulators emphasize that successful accommodations and workouts often depend upon banks’ proactive engagement with borrowers.

Safety & Soundness

It is critical for banks to establish and maintain systems to identify distressed assets and manage any deterioration in the credit quality of these assets. This should be accomplished through prudent credit underwriting and risk management practices so as to reduce bank exposure to credit, compliance, and operational risks.

Repayment Ability

It is critical that borrower parties continue to be creditworthy as well as have the ability and willingness to repay their loans.

Borrower

To determine creditworthiness, the bank should conduct a comprehensive review of, among other things, the borrower’s:

- character

- overall financial condition

- resources

- payment history

Guarantor

Banks are better able to determine the financial capability of a guarantor by reviewing its:

- global financial condition

- income, liquidity, and cash flow

- other factors, including credit ratings when available

Sponsor

Even if not legally obligated, it may be useful for banks to examine the borrower’s sponsor as a potential financial backstop.

Collateral Value

Specific Market Conditions

Banks should focus primarily on local and state real estate market conditions, with less emphasis on regional and national trends.

Re-Appraisals

There are a number of changes in circumstances that may warrant a bank to update its appraisals or other valuations including, but not limited to, variances between actual conditions and original appraisal/valuation assumptions, and the loss of a significant lease or take-out commitment.

As this determination will vary on a case-by-case basis, depending upon the types of collateral pledged and other considerations, banks should use their best judgement on determining the need and frequency of updating collateral information, as well as other pertinent borrower and project information.

Accommodations

Short-term loan accommodations may be a prelude to longer term or more complex restructurings.

Accommodations include deferral of one or more payments, acceptance of a partial payment, forbearance of any delinquent amounts and temporary waivers to financial covenant requirements.

Restructurings

General

Workouts may be required if there are long-term issues in connection with the financed real estate or other issues that may hinder borrower repayment.

Importantly, in a prudent workout, the market value contained in the current or updated appraisal may continue to be utilized.

Types

In addition to the prior guidance addressing (i) income producing properties for (a) office and (b) retail; (ii) construction loans for (a) single family residences and (b) land acquisitions, and condominium construction and conversions; (iii) commercial operating lines of credit; and (iv) land loans, the updated guidance provides additional scenarios addressing:

- income producing properties for hotels

- acquisition, development, and construction of residential properties

- multifamily housing

Loan Reclassifications

Loans to sound borrowers that are modified in accordance with reasoned underwriting standards should not be adversely classified as non-performing loans.

Though it is appropriate to reclassify a loan as non-performing when repayment is jeopardized, this reclassification will not be required solely because the value of the underlying collateral has declined to an amount that is less than the outstanding loan balance.

However, upon a foreclosure, the ‘as is’ fair value, rather than the market value, contained in the appraisal is to be reflected for collateral value purposes.

Conclusion

Encouraging well-structured accommodations and workouts in real estate would positively impact the safety and soundness of the financial system from both a bank, and a borrower, perspective.

It should be noted that this guidance is not directly applicable to the unregulated portion of the financial system – hedge funds, loan brokers, FinTech lenders, among others. The role of these largely unregulated financial institutions has dramatically increased in both volume and types of financial products being offered since the Great Recession and, unfortunately, would not be subject to this updated guidance.

Lastly, this guidance is merely just that – guidance. Consequently, it is unclear whether regulated institutions will adhere to this in the same manner as a regulatory requirement.

Additional research and writing from Sadie O’Connor, a 2023 summer associate in ArentFox Schiff’s Washington, DC, office and a law student at Georgetown University.

Contacts

- Related Practices