ICSID Releases 2022 Caseload Statistics: An Analytical Review and Prognosis of Investment Disputes Post-COVID-19

On January 30, 2023, the International Centre for Settlement of Investment Disputes (ICSID) published its Caseload Statistics for the 2022 calendar year.

The Caseload Statistics can be found here, and ICSID’s accompanying press release can be viewed here.

ICSID is one of the five organizations of the World Bank Group. It was established in October 1966, pursuant to the ICSID Convention to facilitate the resolution of disputes between foreign investors and sovereign states.

In this update, we review the 2022 Caseload Statistics and provide a prognosis of the future use of the ICSID dispute resolution process in the mining, energy, and infrastructure sectors.

Historical Trends

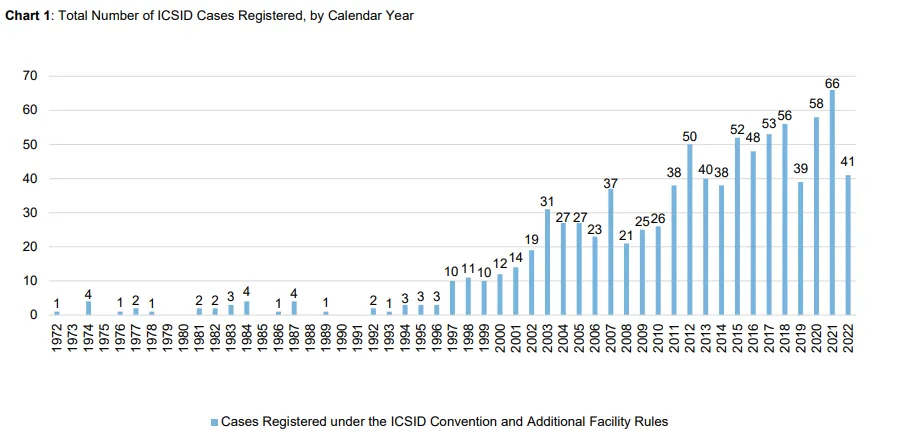

The latest ICSID Caseload Statistics, in addition to providing case-related trends in 2022, also provide data on all cases registered by ICSID over the past 50 years. After an extremely slow beginning, significant upward usage of ICSID’s dispute resolution provisions began 20 years ago. Since then, there has been an overall significant upward utilization of ICSID. There are currently 165 members of the ICSID Convention. The list of Contracting States can be viewed here.

As of December 31, 2022, ICSID has registered a total of 821 cases under the ICSID Convention and 76 cases under the Additional Facility Rules. The number of conciliation cases remains low, at approximately 13. Since the first case in 1972, there have been 910 total cases registered by ICSID.

ICSID also administers cases under other non-ICSID procedural rules. In 2022, ICSID administered 21 such cases, with the arbitration rules of the United Nations Commission on International Trade Law (UNCITRAL) being the most common (accounting for 15 cases).[1]

(See ICSID Caseload Statistics, dated Jan. 30, 2023, p. 7)

Number of Registered Cases Returns to Pre-Covid-19 Levels

According to ICSID, a total of 41 new cases were registered in 2022, marking a decrease as compared to the 66 cases registered in 2021 and the 58 registered in 2020. Nevertheless, this was an increase in cases compared to the 39 registered in 2019.

Of the 41 cases, 34 were registered under the ICSID Convention with another seven cases under ICSID’s Additional Facility Rules.

Treaty-Based Cases Dominate

The vast majority of cases registered in 2022 were initiated by foreign investors under Bilateral Investment Treaties (BITs), also known as foreign investment promotion and protection agreements (FIPPAs). These cases account for 54% of all new cases registered in 2022, followed by cases arising under the Energy Charter Treaty (ECT) (22%), and cases based on contracts between investors and host states (12%).

In addition, 2022 saw a variety of regional trade investment agreements invoked by investors, such as the North American Free Trade Agreement (NAFTA) based on the three-year “legacy period” provisions (which will become ineffective on July 1, 2023), contained within the United States–Mexico–Canada Agreement (USMCA) (the USMCA replaced NAFTA as of July 1, 2020), the ASEAN-China Investment Agreement, as well as the Dominican Republic-United States-Central America Free Trade Agreement (CAFTA).

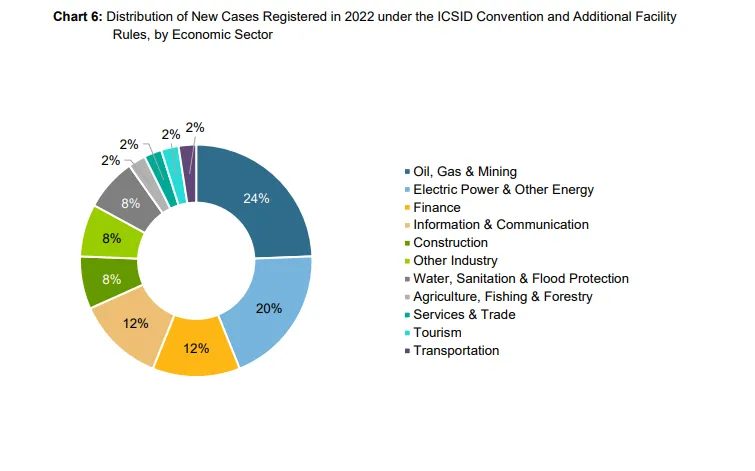

Economic Sectors

The extractive and energy sectors accounted for 44% of all cases registered in 2022, with oil, gas, and mining making up 24% of the cases, and electric power and other energy sources amounting to 20% of the cases.

Of the remaining 56% of the cases: 8% each (or a total of 24% on a combined basis) were from construction, water sanitation, and flood protection sectors; 12% were from finance, information, and communications; 2% (or a total of 12% on a combined basis) each were from agriculture, fishing, and forestry, tourism, transportation, trade, and services; and a mix of other sectors amounted to 8% of the registered cases in 2022.

(See ICSID Caseload Statistics, dated Jan. 30, 2023, p. 25)

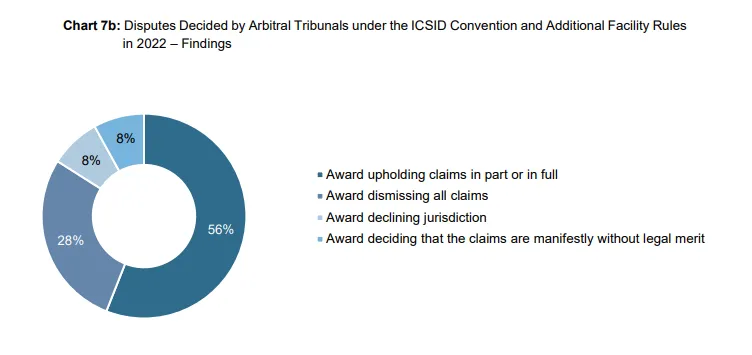

Case Outcomes Between States and Investors

Following the recent historical trend at ICSID, 2022 revealed a relatively balanced outcome of cases between states and foreign investors. Among cases decided, 56% of awards upheld the investor’s claims in full or in part, and 28% of the cases concluded with the dismissal of all claims. In the remaining 16% of cases, tribunals either declined jurisdiction or found that the claims were manifestly without legal merit.

(See ICSID Caseload Statistics, dated Jan. 30, 2023, p. 27)

Geographical Diversity and Gender Equality on ICSID Tribunals

As in previous years, ICSID tribunals were significantly composed of arbitrators from Western Europe (40%), followed by arbitrators from North America (25%) and South America (20%). These figures reflect a small decrease in tribunal diversity from 2021, but show a very slight improvement in comparison to the figures for 1966-2020, during which period over two-thirds of appointments were of nationals from Western Europe or North America.

The distribution of appointments by gender has also similarly remained unbalanced. In 2022, 23% of the appointed arbitrators, conciliators, and ad hoc committee members were women, a slight decrease compared to the 27% appointed in 2021, but equal to the 23% appointed in 2020.

Trends for 2023 and Subsequent Years

We expect to see the number of cases filed with ICSID over the next few years to continue the historical general upward trend line, particularly in sectors such as mining, oil, gas, electric power (including renewable power projects), financial sector, and telecommunications. This is partly due to increasing awareness over the last 20 years on the part of private investors and their advisors of the available means for bringing such cases for dispute resolution before ICSID, accompanied by a track record of successful outcomes for meritorious cases. Increased availability of third-party funding has also made the system more accessible to a larger group of users.

Additionally, there are now far more BITs and other investment treaties and agreements than was the case in the early 1990s. The number of treaties and agreements providing access to investor-state arbitration has increased from less than 100 in the beginning of the 1990s, to over 2,600 in 2020, with the numbers quadrupling in the 1990s. (See UNCTAD Study on Recent Developments in the IIA Regime here) Furthermore, they are not limited to arrangements between the developed and less developed countries, as was the case in the past. They have proliferated throughout the world, including among developed economies, and now easily approximately the number of avoidance of double taxation treaties universally in force at this time.

Finally, we are of the view that the reversal of government policies (particularly in emerging market countries) that had previously increasingly been based on free market principles with limited government involvement (many of which were adopted in the 1990s and the early part of the first decade in this century), will result in an uptick in cases filed with ICSID over the next few years. The reversal of liberal economic policies gained further momentum during the COVID-19 period and the aftermath (when government revenues and finances suffered and governments began adopting protectionist policies). While the number of cases in 2022 declined somewhat from the previous two years (2020-21), our prognosis is that changes in the economic and trade policies adopted prior to and during the COVID-19 period could adversely impact foreign investors to a sufficient degree in the coming years, so as to lead to an increase in cases filed with ICSID.

[1] Investor-State arbitration cases can also be conducted under the UNCITRAL Arbitration Rules and other arbitration rules, whether or not administered by ICSID, and therefore the ICSID reported cases do not account for all investor-arbitration proceedings.

Contacts

- Related Practices